Tag Archives: amazon

Back to the Black on free promotion

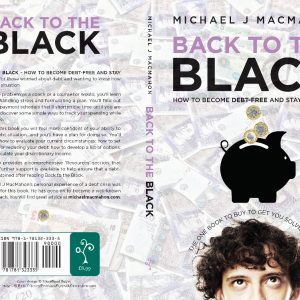

9781781323335-Perfect.indd

Breaking news!

The Kindle version of Back to the Black …. how to become debt-free and stay that way (second edition) will be available as a free download from 1st – 5th March inclusive.

The promotion applies to all territories.

Here are the links to access your free copy during the promotion:

US / worldwide: http://amzn.to/2lg2PfV

Win Champagne with the ‘Scrooge and Splurge Challenge’

A launch event for a Bristol author’s personal finance book also launched a new challenge. ‘Scrooge and Splurge’ stands for small economies, followed by large extravagances. The author offers a bottle of champagne for readers’ entries. Continue reading

Debt: Self-Employed People Struggling, Says Charity

A report by the debt advice charity StepChange pointed up two main issues:

1. Regional variations in debt burden.

2. The special risks for self-employed people. Continue reading

NEW EDITION OF ‘BACK TO THE BLACK’

New edition of ‘Back to the Black … how to become debt-free and stay that way’ published on 21 January 2015. Continue reading

DEBT: SELF-EMPLOYED PEOPLE AFFECTED MORE?

A recent report by the debt advice charity StepChange points up two main issues:

- Regional variations in debt burden

- The special risks for self-employed people.

There are bound to be regional variations in almost anything. What was notable, though, is that the region where people are spending the highest proportion (30%) of their disposable income on debt interest payments, is the South East.

However, the section in the summary that hit me in the face was this:

“Self-employed struggling: partly because of high levels of secured borrowing – possibly taken out to keep businesses afloat – self-employed people advised by the charity owed on average £300,000.

“Clients in part-time or full-time employment had an average debt load of 4.1 times their income. For self-employed people this rises to 18.6 times their income.”

[Note: The figures apply to debtors who are or were clients of the charity. They are not necessarily typical of the population as a whole.]

The difference between 4.1 and 18.6 is remarkable; and I can empathise, because I was in the same situation fifteen years ago. I had a business that had done well for five or more years but then “fell on hard times”, to put it euphemistically. Like the clients of StepChange, I increased my borrowings (secured or unsecured, they were still debts) in an attempt to keep the business afloat. By the time I decided that would not work, closed the business and concentrated 100% on solving the debt problem, my total borrowings were several times my income. Not eighteen times, but a lot.

How I solved the problem is told in my book “Back the Black: how to become debt-free and stay that way.” (Amazon: paperback and Kindle eBook)

WANT TO KNOW MORE?

For a copy of the report by StepChange:

http://www.stepchange.org/Portals/0/Documents/media/reports/cebr%20q3%202012.pdf

TURNS OUT I’M A SELF-PUBLISHING EXPERT

All expertise is relative, I always say. Based on that assumption, I became a self-publishing expert recently Continue reading

DEBT AND DEPRESSION

In my book “Back to the Black”, I talk about the psychological effects of being in debt. In fact Chapter 2 is entitled “Mind Over Matter.”

I was pleased to see that this important issue was covered in a recent article by Simon Read in “The Independent” (17 March 2012). I’ll take the liberty of paraphrasing:

*****

Being in debt is a depressing experience.

“A trouble shared is a trouble halved”; but the annual report of Consumer Credit Counselling Service (CCCS) shows 25% of those in debt don’t share their troubles with friends or family.

It’s understandable that people don’t want to discuss their debt problems. They’re embarrassed that they might be judged.

Admit the problem; don’t delay

However, admitting you’re in financial trouble is the first step towards solving the problem.

CCCS also revealed that 45 per cent of people delayed seeking advice for more than a year after they started to worry they had a debt problem. Many of them had probably carried the worry alone.

Suicides

Many tragic suicides are caused by the worry of debt (and for every suicide there are ten attempted suicides). If those people had been able to talk about their problems, who knows what kind of future they may have had?

Talk to someone

Don’t just worry about debt. Instead look for a way to deal with it. There are many people and organisations that can help.

Help is at hand

CCCS (and the other debt advice charities: see below) are on hand to help.

All of them can help those in debt find ways to put their finances back on track.

Friends and family

Just talking to friends and family could be a good first step on the way to coping with the deep anxiety that money worries cause.

*****

I had intended to add some thoughts of my own to this; but I think that the article says what needs to be said. I’ve just added information about organisations that can help; see below.

*****

WANT TO KNOW MORE?

ADVICE ORGANISATIONS: CONTACT DETAILS

1. NATIONAL DEBT ADVICE CHARITIES

(THESE ALL OFFER CONFIDENTIAL AND FREE DEBT ADVICE, UK-WIDE)

Citizens Advice (“The CAB”)

Free advice provider; registered charity. Funders include central and local government, charitable trusts, companies and individuals.

Face-to-face interviews and telephone advice available at local Citizens Advice Bureaux (CABs). Find your nearest bureau in the phone directory, or search at www.citizensadvice.org.uk

E-mail advice available at some CABs

Advice line: 0844 499 4718

Online help also available: www.adviceguide.org.uk

CCCS (Consumer Credit Counselling Service)

Free advice provider; registered charity. Supported almost entirely by the credit industry.

Telephone counselling 0800 138 1111

Online help www.cccs.co.uk

National Debtline

Free advice provider; registered charity. Part of the Money Advice Trust, (see below) funded by a mix of private sector donations and Government grants.

Phone advice and free factsheet orders: 0808 808 4000

Credit Action

Money education charity, in partnership with CCCS (see above). Free online advice provider, plus the Spendometer (see Chapter 8), Money Manuals and other resources: www.creditaction.org.uk.

Their “Money Advice Map” signposts to local debt advice centres: www.moneyadvicemap.com/

***

2. LOCAL INDEPENDENT DEBT ADVICE ORGANISATIONS ALSO EXIST IN MANY AREAS AND ARE TOO NUMEROUS TO LIST.

***

3. OTHER ORGANISATIONS WITH HELPLINES OR WEBSITES ON DEBT AND RELATED ISSUES

AdviceUK (to find a local money advice centre)

020 7407 4070

Debtors Anonymous (worldwide community with telephone & online meetings)

… and to find contact details for local meetings inUK:

Mind (charity & helpline that helps with mental health problems)

0845 7660 163

Samaritans (confidential emotional support)

0845 790 9090

Saneline (support for mental illness)

0845 767 8000

Shelter (free housing advice helpline)

0808 800 4444

***

For the “Independent” article in full: LINK

***

For info about my book “Back to the Black: how to become debt-free and stay that way” (paperback and eBook): LINK

“BACK TO THE BLACK” – NOW IN PAPERBACK TOO

The paperback version of my book “Back to the Black: how to become debt-free and stay that way” is now available on Amazon.com.

It encapsulates what I learned from my own debt problem a few years ago, when I very nearly had to file for bankruptcy but found another way.

Hopefully the lessons I learned are set out in such a way as to help others who might now be in the same situation as I was.

The marketing material reads as follows:

- Worried about debt? This book shows how to handle stress, to optimise your repayment schedule; to budget and track spending.

- You’ll feel confident of your ability to handle the debt and will have a plan for doing so. You’ll learn to evaluate today’s situation and decide realistic goals; to develop options and calculate discretionary income.

- Armed with that information, decisions will seem easier.

You can also find a kindle version on Amazon; a .pdf version on my own site: and other e-formats in the Smashwords store.

WANT TO KNOW MORE?

For the paperback version of “Back to the Black”: LINK

For the ebook versions:

Smashwords, for a multi-format ebook: LINK

Kindle store: LINK

For .pdf only: LINK

REPAIR YOUR CREDIT RATING

Most financial experts say that it’s important to maintain a good credit rating, even if you are not planning to increase your borrowings in the near future. At some point in the future you may well want to do so; at that point, if your credit rating is poor, or simply inaccurate or out-of-date, it could cause you problems. At the very least it could cause you delays.

As I have mentioned before, I subscribe to “Moneywise” magazine and I find it a useful resource. It’s also a quick read, which is very important to many people. I wish I had known about it back in the late ‘90s when I faced my own debt problems. Being in debt is stressful and that’s why very often advice needs to be clear and succinct.

This month’s issue of the magazine contains a helpful article on the very question of boosting your credit rating. The article is not available yet on the Moneywise website, so you’ll have to buy the magazine to read the full piece. (March 2012, page 44; good value, I’d say, at £3.95)

To summarise:

- Get hold of your credit report from one of the three main credit reporting agencies in the UK: Experian, Call Credit and Equifax. They are required by law to provide a basic one for £2.

- Look for mistakes; lenders often misreport and still show debts as being unsatisfied, even though they have been paid in full.

- Check for old addresses: are your old addresses in there? Are they spelled correctly? You need evidence of your past payment performance.

- Check for hidden debts: balances that had built up of which you were unaware. (e.g. forgotten direct debits on unused accounts)

- Show your stability. Long relationship with one bank? Landline phone? On electoral roll?

- Cancel unused credit cards, debts, accounts. (I myself need to look at this; I have several cards I never use)

- Get a credit card, if you haven’t got one. This seems illogical but it’s a good strategy. Manage it sensibly; that provides evidence of your “probity”.

- Be careful who you link your finances to. Applying for joint credit will link your credit reports, of course.

- Don’t make lots of applications for credit at the same time.

- The Golden Rule: don’t miss payments. If you can’t avoid missing one, contact the lender / credit card company in advance; don’t just default.

CREDIT SCORING ADVICE FROM A CREDIT RATING AGENCY

Way back in 2004 I found a great online resource on this subject from Equifax. That’s really “from the horse’s mouth”, because they are one of the three UK companies mentioned above, who do the credit reporting. The information is still valid and it’s still on Equifax’s website.

The title was “Rebuilding Damaged Credit”. Some of the advice overlaps with that of “Moneywise”, some not. Here’s a summary of it:

Open new accounts … and pay them off

Being able to repay a variety of new accounts helps rebuild your credit. Opening and paying off as many different kinds of accounts as you can is better than adding more debt to an existing credit card.

Start small

Rebuilding your credit can be similar to starting over from scratch; starting small may be the easiest option. Credit cards from department stores can be useful. (Warning: if you don’t pay the full balance every month, their interest rates tend to be among the highest)

Consider asking for help

If you can’t qualify on your own, ask a friend or family member to co-sign for a small loan or credit card.

Consider a secured credit card

They are guaranteed by a deposit that you make with the credit grantor; they offer the purchasing power of a major credit card. Make sure the grantor reports payment histories to a credit reference agency, so you’re building your positive payment history.

Use new accounts in moderation

And make payments that are more than the minimum.

Keep balances low

Avoid carrying a balance that is more than 30% of your credit limit, because creditors may view that as excessive debt.

The bottom line

It’ll take time for your new credit history to gain momentum, so be patient. You’re demonstrating your financial reliability; that’s why opening and paying down accounts may make it a little easier to get more credit in the future if you need it.

WANT TO KNOW MORE?

For the resources mentioned above:

For the Equifax resource in full: http://www.equifax.co.uk/Products/learning-centre/rebuilding_damaged_credit.html

For a short “Moneywise” video on improving credit rating: http://www.moneywise.co.uk/cards-loans/credit-cards/how-to-improve-your-credit-record-tv

For the article: “Ten ways to boost your credit rating”. Available in “Moneywise”, March 2012, page 46.

For info and links re my e-book “Back to the Black: how to become debt-free and stay that way”, click HERE.

It’ll also be available in paperback from Amazon in a couple of weeks; I have the proof copy in my hand right now.