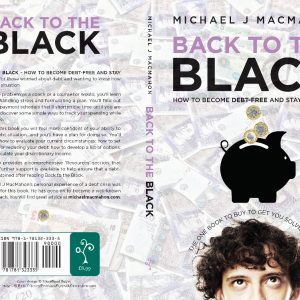

In my book “Back to the Black”, I talk about the psychological effects of being in debt. In fact Chapter 2 is entitled “Mind Over Matter.”

I was pleased to see that this important issue was covered in a recent article by Simon Read in “The Independent” (17 March 2012). I’ll take the liberty of paraphrasing:

*****

Being in debt is a depressing experience.

“A trouble shared is a trouble halved”; but the annual report of Consumer Credit Counselling Service (CCCS) shows 25% of those in debt don’t share their troubles with friends or family.

It’s understandable that people don’t want to discuss their debt problems. They’re embarrassed that they might be judged.

Admit the problem; don’t delay

However, admitting you’re in financial trouble is the first step towards solving the problem.

CCCS also revealed that 45 per cent of people delayed seeking advice for more than a year after they started to worry they had a debt problem. Many of them had probably carried the worry alone.

Suicides

Many tragic suicides are caused by the worry of debt (and for every suicide there are ten attempted suicides). If those people had been able to talk about their problems, who knows what kind of future they may have had?

Talk to someone

Don’t just worry about debt. Instead look for a way to deal with it. There are many people and organisations that can help.

Help is at hand

CCCS (and the other debt advice charities: see below) are on hand to help.

All of them can help those in debt find ways to put their finances back on track.

Friends and family

Just talking to friends and family could be a good first step on the way to coping with the deep anxiety that money worries cause.

*****

I had intended to add some thoughts of my own to this; but I think that the article says what needs to be said. I’ve just added information about organisations that can help; see below.

*****

WANT TO KNOW MORE?

ADVICE ORGANISATIONS: CONTACT DETAILS

1. NATIONAL DEBT ADVICE CHARITIES

(THESE ALL OFFER CONFIDENTIAL AND FREE DEBT ADVICE, UK-WIDE)

Citizens Advice (“The CAB”)

Free advice provider; registered charity. Funders include central and local government, charitable trusts, companies and individuals.

Face-to-face interviews and telephone advice available at local Citizens Advice Bureaux (CABs). Find your nearest bureau in the phone directory, or search at www.citizensadvice.org.uk

E-mail advice available at some CABs

Advice line: 0844 499 4718

Online help also available: www.adviceguide.org.uk

CCCS (Consumer Credit Counselling Service)

Free advice provider; registered charity. Supported almost entirely by the credit industry.

Telephone counselling 0800 138 1111

Online help www.cccs.co.uk

National Debtline

Free advice provider; registered charity. Part of the Money Advice Trust, (see below) funded by a mix of private sector donations and Government grants.

Phone advice and free factsheet orders: 0808 808 4000

www.nationaldebtline.co.uk

Credit Action

Money education charity, in partnership with CCCS (see above). Free online advice provider, plus the Spendometer (see Chapter 8), Money Manuals and other resources: www.creditaction.org.uk.

Their “Money Advice Map” signposts to local debt advice centres: www.moneyadvicemap.com/

***

2. LOCAL INDEPENDENT DEBT ADVICE ORGANISATIONS ALSO EXIST IN MANY AREAS AND ARE TOO NUMEROUS TO LIST.

***

3. OTHER ORGANISATIONS WITH HELPLINES OR WEBSITES ON DEBT AND RELATED ISSUES

AdviceUK (to find a local money advice centre)

020 7407 4070

www.adviceuk.org.uk

Debtors Anonymous (worldwide community with telephone & online meetings)

www.debtorsanonymous.org/

… and to find contact details for local meetings inUK:

www.debtorsanonymous.org.uk/

Mind (charity & helpline that helps with mental health problems)

0845 7660 163

www.mind.org.uk

Samaritans (confidential emotional support)

0845 790 9090

www.samaritans.org

Saneline (support for mental illness)

0845 767 8000

www.sane.org.uk

Shelter (free housing advice helpline)

0808 800 4444

www.shelter.org.uk

***

For the “Independent” article in full: LINK

***

For info about my book “Back to the Black: how to become debt-free and stay that way” (paperback and eBook): LINK